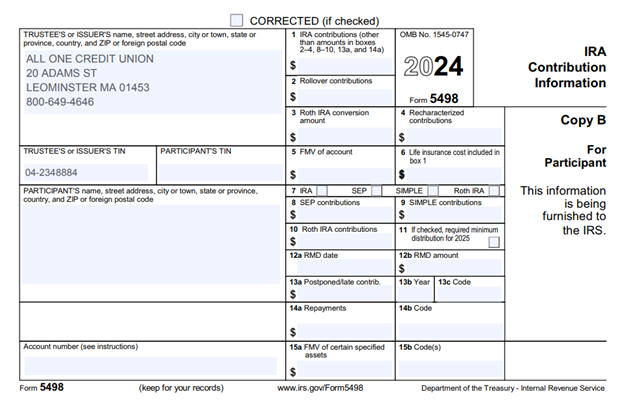

IRA 5498 Tax form:

Q. What is a 5498 Tax Doc?

A. A 5498 is an Informational Document. The mailing deadline to members is May 31st.

Q. Where do I find the required distribution amount if box #11 is checked?

A. If member is in required minimum distribution period a separate Fair Market Value and Required Minimum Distribution Statement will be mailed indicating new amount for upcoming year.

Q. Where do I find the date I need to take my distribution by?

A. Box 12a will provide the date of when you must take your required minimum distribution.

Below please find a blank 5498 and following are descriptions of what each box represents on the form.

Please feel free to contact us at 800-649-4646 should you have any questions.

Instructions for Participant

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any catch-up contributions, rollovers, repayments, required minimum distributions (RMDs), and the fair market value (FMV) of the account. For information about IRAs, including reporting rollovers, repayments, and potential deductibility of contributions, see the instructions for Forms 1040, 1040-SR, and 8606; and Pubs. 560, 590-A, and 590-B.

Participant’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the trustee or issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the trustee or issuer assigned to distinguish your account.

Box 1. Shows traditional IRA contributions for 2024 you made in 2024 and through April 15, 2025. This box does not include amounts in boxes 2–4, 8–10, 13a, and 14a.

Box 2. Shows rollover contributions, including direct rollover contributions, you made in 2024 to an IRA (other than conversions done through a rollover contribution from a traditional IRA or traditional SIMPLE IRA to a Roth IRA or Roth SIMPLE IRA, which are reported on Box 3). Include a military death gratuity or SGLI payment to a Roth IRA. Any late rollover contributions are shown in box 13a.

Box 3. Shows the amount converted from traditional IRAs or traditional SIMPLE IRAs to Roth IRAs or Roth SIMPLE IRAs in 2024.

Box 4. Shows amounts recharacterized from transferring any part of the contribution (plus earnings) from one type of IRA to another.

Box 5. Shows the FMV of all investments in your account at year end. However, if a decedent’s name is shown, the amount reported may be the FMV on the date of death. If the FMV shown is zero for a decedent, the executor or administrator of the estate may request a date-of-death value from the financial institution.

Box 6. Shows for endowment contracts only the amount allocable to the cost of life insurance. Subtract this amount from your allowable IRA contribution included in box 1 to compute your IRA deduction.

Box 7. May show the kind of IRA reported on this Form 5498.

Boxes 8 and 9. Show SEP (box 8) and SIMPLE (box 9) contributions made in 2024, including contributions made in 2024 for 2023, but not including contributions made in 2025 for 2024.

Box 10. Shows Roth IRA contributions (and rollovers from a QTP) you made in 2024 and through April 15, 2025. Do not deduct on your income tax return.

Box 11. If the box is checked, you must take an RMD for 2025. An RMD may be required even if the box is not checked. If you do not take the RMD for 2025, you are subject to an excise tax on the amount not distributed.

Box 12a. Shows the date by which the RMD amount in box 12b must be distributed to avoid the excise tax on the undistributed amount for 2025.

Box 12b. Shows the amount of the RMD for 2025. If box 11 is checked and there is no amount in this box, the trustee or issuer must provide you the amount or offer to calculate the amount in a separate statement by January 31, 2025.

Box 13a. Shows the amount of a late rollover contribution (more than 60 days after distribution) made in 2024 and certified by the participant, or a postponed contribution made in 2024 for a prior year. This amount is not reported in box 1 or 2.

Box 13b. Shows the year to which the postponed contribution in box 13a was credited. If a late rollover contribution is shown in box 13a, this box will be blank.

Box 13c. Shows the applicable code for a postponed contribution amount shown in box 13a: FD (due to an extension of the contribution due date because of a federally designated disaster), PO (a rollover of a qualified plan loan offset), and SC (the self-certification procedure for a late rollover contribution). For participants who served in designated combat zones, qualified hazardous duty areas, or direct support areas, the codes are EO13239 for Afghanistan and associated direct support areas, EO12744 for the Arabian Peninsula areas, PL115-97 for the Sinai Peninsula of Egypt, and EO13119 (or PL106-21) for the Yugoslavia operations areas. For additional information, including a list of locations within the designated combat zones, qualified hazardous duty areas, and direct support areas, see Pub. 3. For updates to the list of locations, go to www.irs.gov/Newsroom/Combat-Zones.

Box 14a. Shows the amount of any repayment of a distribution related to a qualified reservist, qualified disaster, qualified birth or adoption, emergency personal expense, domestic abuse victim, or terminally ill individual.

Box 14b. Shows the applicable repayment code for the amount shown in box 14a: QR (qualified reservist), DD (qualified disaster), BA (qualified birth or adoption), EP (emergency personal expense), DA (domestic abuse victim), or TI (terminally ill individual).

Box 15a. Shows the FMV of the investments in the IRA that are specified in the categories identified in box 15b.

Box 15b. The following codes show the type(s) of investments held in your account for which the FMV is required to be reported in box 15a.

A—Stock or other ownership interest in a corporation that is not readily tradable on an established securities market.

B—Short- or long-term debt obligation that is not traded on an established securities market.

C—Ownership interest in a limited liability company or similar entity (unless the interest is traded on an established securities market).

D—Real estate.

E—Ownership interest in a partnership, trust, or similar entity (unless the interest is traded on an established securities market).

F—Option contract or similar product that is not offered for trade on an established option exchange.

G—Other asset that does not have a readily available FMV.

H—More than two types of assets (listed in A through G) are held in this IRA.